Our Objective

To deliver the strongest possible risk adjusted returns to our clients.

Our Process

EGP Capital primarily invests for the long term. Since inception, the fund’s average holding period has approached 10-years. The reason for this uncommonly long average holding period is a stringent focus on deep research prior to buying excellent businesses with skilled management, operating in industries with favourable long-term trends. Such positions will usually comprise the largest part of the portfolio.

Occasionally we own businesses for shorter holding periods. These are businesses that sometimes don’t exhibit the same qualitative factors as our largest holdings, but commonly have in-built protections such as a high level of tangible assets, or an exceptionally cheap purchase price relative to the medium-term prospects of the business. It is imperative that there be a demonstrable mispricing in the risk-reward situation before we will invest.

We do not use leverage or invest in complex financial products or derivatives.

Our Portfolio

We have an unconstrained investment mandate. We are able to buy any asset globally that we feel will deliver a strong risk adjusted return. We can hold up to 100% cash as occasion may warrant and ‘short-sell’ if suitable opportunities exist. Despite this wide-ranging mandate, in practical terms, EGP Capital:

- Holds mostly Australian listed smaller capitalisation businesses

- Holds between 10-20% in cash

- Targets 25 – 35 stocks, of which:

- the 5 largest holdings usually comprise almost 50% of the equity portfolio

- the 15 largest holdings usually comprise about 75%

- Only very occasionally uses shorting or arbitrage

Our Benchmark

We originally benchmarked ourselves against the S&P/ASX 200 Franking Credit Adjusted Annual Total Return Index (Tax-Exempt). The ASX200 is Australia’s premier equity index. We used the Franking Credit adjusted version of the index because the tax-adjusted nature of this index allows the fairest comparison against our own tax adjusted results.

In the new Unit Trust structure originating on August 15th 2017, we now use the S&P/ASX 200 Total Return Index.

Management Fees

EGP Capital charges no management fee.

Performance Fee

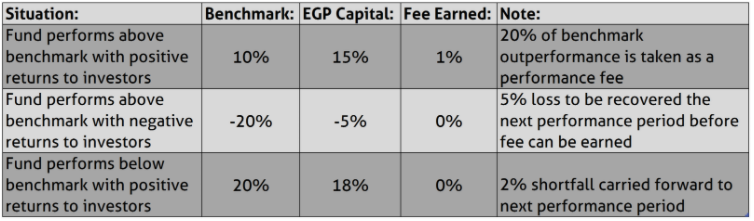

20% (plus GST) of outperformance above the S&P/ASX 200 Total Return Index, applied only in years with a positive return for the first $50m of assets under management (AUM). 15% (plus GST) of outperformance for all AUM above $50m (i.e. at $100m AUM, fee is 17.5% of ouperformance. At $300m AUM, fee is 16% of outperformance)

Examples on first $50m of AUM:

Administration Fees

Historically, operating costs of the fund ran below 10 basis points annually. This fee was capped at 25 basis points whilst the original structure was employed.

On August 15th 2017, a new vehicle operating as a Unit Trust (EGP Concentrated Value Fund) was created, incorporating an external Trustee, Custodian and requiring an AFSL. Administration costs have increased in this structure (refer to the Product Disclosure Statement), but are still expected to run below 25 basis points per annum.

EGP Capital Pty Ltd (ABN 32 145 120 681) (AFSL #499193) (EGP Capital) is the issuer of this webpage.