The fund took on its last ever new investors this month. As I said in the September 2017 monthly letter, we consider the small investor group we will take forward with EGP Concentrated Value Fund to be like a club that had a very small window of opportunity to join. We will work intently over coming years to ensure the membership is a lucrative, enjoyable and valuable one.

Part of that value will come from our commitment to being more open about the construction of our portfolio. Now that the fund is closed to new investors, concerns we may previously have had that potential investors might (instead of investing) mimic our portfolio often caused us to be circumspect about our portfolio holdings. Now that the opportunity to join the EGPCVF club has passed, we are happy to discuss some of our portfolio ideas in more depth to assist our investors in understanding what we’ve invested your money in and why.

We will usually wait until we have completed our buying program in a stock before disclosing, but the first investment revealed since the inception of EGPCVF will be one we have been buying this month and may continue buying in future months if the story plays out as we expect and the pricing remains tempting.

Anyone interested in a snapshot of our investment thesis for our holding of Locality Planning Energy (LPE.ASX) can read here.

LPE.ASX is an investment that falls neatly into my investment circle of competence due to my many years spent working in the electricity industry. It is not a ‘moat’ business, but it is one that offers a compelling value proposition to its customers and in a period where electricity prices comprise a large and growing part of household budgets, we consider that an extremely useful tailwind.

Despite a good understanding of the industry in which LPE.ASX operates, it remains a business in the fairly early stage of its business model and as such warrants the caution we have displayed in the way we have sized the position so far.

The stock is our 10th largest holding at the end of September, and will not likely become a top five holding unless the profitability expands more rapidly than I have anticipated whilst pricing remains depressed, giving us the opportunity to accumulate a larger holding – Tony Hansen (05/10/2017)

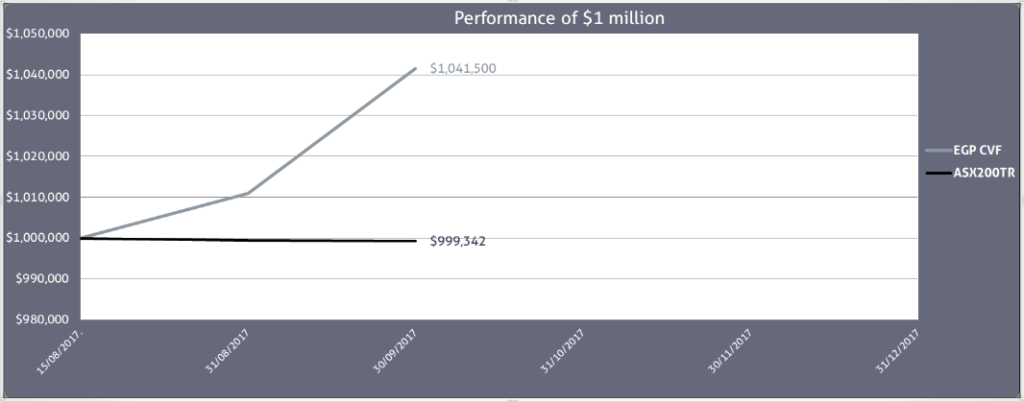

| August 15th 2017 | ..Current Price.. | ..FYTD.. | ..Annualised.. | |

| ..EGP CVF | 1.0000 | 1.0415 | 4.15% | 38.44% |

| Benchmark .. | 56174.93 | 56137.99 | (0.07%) | (0.56%) |

DISCLAIMER:

EGP Capital Pty Ltd (ABN 32 145 120 681) (EGP Capital) is the holder of AFSL #499193. None of the information provided is, or should be considered to be, general or personal financial advice. The information provided is factual information only and is not intended to imply any recommendation or opinion about a financial product. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should consider seeking your own independent financial advice before making any financial or investment decisions. The information provided in this presentation is believed to be accurate at the time of writing. None of EGP Capital, Fundhost or their related entities nor their respective officers and agents accepts responsibility for any inaccuracy in, or any actions taken in reliance upon, that information. The EGP Concentrated Value Fund (ARSN 619879631) (Fund) discussed in this report is offered via a Product Disclosure Statement (PDS) which contains all the details of the offer. The Fund PDS is issued by Fundhost Limited (AFSL 233045) as responsible entity for the Fund. Before making any decision to make or hold any investment in a Fund you should consider the PDS in full. The PDS will be made available by contacting EGP Capital (info@egpcapital.com.au). Investment returns are not guaranteed. Past performance is not an indicator of future performance.