I will send out the ‘Offer to Invest’ this week. To anyone who wishes to receive the offer, but has not made contact with me yet, send an e-mail to Tony@eternalgrowthpartners.com to receive the offer e-mail.

This will be a post that is only at best tangentially related to investing. Some ideas in it, to be sure, can usefully be applied to investing, but that is not why I’ve written it.

I attended the AGM in Kuala Lumpur this week of one of our largest and most important shareholdings. I will fly home tomorrow to make sure your dividend is processed and for those not taking the cash (all of you – thanks for your ongoing belief in me), your new EGP shares issued.

We closed the gap on the market this week, now trailing by only 0.25% since January 1st. You could be forgiven for suspecting we hold a portfolio that closely resembles the ASX200, given how closely we’ve tracked the market in 2014 – never more than a couple of percent above or behind. Believe me when I say, our portfolio looks nothing like the ASX200 and you should expect wider variations (hopefully positive ones) in the second half of 2014 and deeper into the future.

It has been a big week; Update No. 163 will be brief.

As mentioned in last weeks post, I set aside this post to cover my visit last weekend to the Berkshire Hathaway Annual General Meeting.

I always enjoy travelling in the United States. Well not so much the travel itself, that’s tedious no matter where you do it, but there is positivity (most) Americans have that I don’t feel when I speak to residents of other countries. It’s a big part of the reason big ideas get off the ground here that might struggle to gain traction in Australia, or other countries. There are more investors here willing to set aside (some of) their capital for really ambitious ideas.

Both the benchmark and the Fund were up over 1% in the public-holiday shortened week just passed.

It may not be obvious in the share price, but EGP just had its best week of 2014. One cannot always tell when good portfolio construction will pay off; in fact it has a funny habit of coming in fairly rapid chunks for no apparent reason a lot of the time. But if we hold a portfolio with the right mix of businesses, which we think we do, we are quite sure it will come eventually. Our mix improved substantially this week, in ways I will talk about further in due course.

I said in last week’s post you could expect some volatility in EGP’s share price as our 2nd largest holding, Dicker Data tries to find its correct price in the eyes of Mr. Market.

A pretty large (well above market) spike took EGP’s share price to an all-time high this week. This spike was in a large part driven by a single stock.

We are 3 years old as at this update. Well, we deployed first capital on April 1 2011, so the birthday is a couple of days away yet…

The market (and EGP) continued its relatively flat start to the year this week. EGP is now up a modest 1.25% for 2014, the market is up 0.99%. As opportunity would have it, the fund has deployed more capital in March 2014 (and the month isn’t over yet) than we have in any month since November 2012.

The invitation to invest went out last weekend. The new stock will be issued on 30 March, so funds will need to be received before then, if you had wanted to receive an invitation to invest, but didn’t, please contact me through the e-mail set-out on the website.

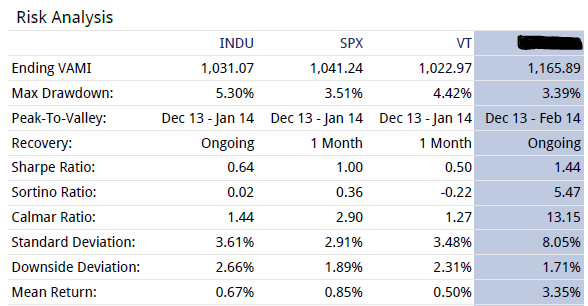

Our last portfolio metrics post came after FY2013 reporting season in Update No. 128. It seems like only a blip, but another reporting season has gone by, this time HY2014.