I will be brief.

We managed to take only a small loss in a week where the market was down quite a bit.

I have appended the 3rd quarter report to the reporting tab. People have asked me why I bothered to make the correction as set out in the 3rd last paragraph of the report. Although it was an immaterial difference, I defer to Albert Einstein on such matters: “Whoever is careless with the truth in small […]

Our performance letter for quarter 3 was delivered to holders this morning.

Our run of consecutive positive weeks ended this week at 14. We declined by 0.04% this week, the benchmark fell by 0.91%.

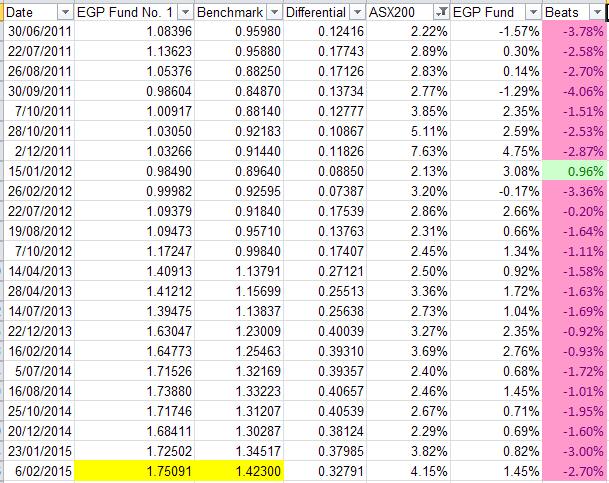

This blog will be dedicated to the bi-annual ‘Portfolio Metrics’ review.

Our invitation to invest email goes out this weekend, if you would like to receive it, drop me an e-mail at Tony@eternalgrowthpartners.com and I will include you in the offer. There is, of course, no obligation – but despite trailing the market so far in FY2015, we still have an annualised 6.5% outperformance of the ASX200 including dividends and with 18 days remaining in our fourth year of operation, have delivered 80.58% after all fees/costs to our foundation investors.

I mentioned last week that I would go over my two favourite investment metrics this week.

Reporting season is over and I am dealing with the usual last night dump as many of our holdings are customarily last minute reporters. Small firms often are.

Reporting season has been quite interesting. At the end of the market we tend to focus on, there are always a few surprises this time of year.

For the first time since inception, the fund has had 9 consecutive positive weeks.

Both the benchmark and EGP both hit all-time highs this week. That’s the good news.

I have a confession to make.

Our benchmark was up 3.82% this week. A rise in the benchmark of more than 3% has occurred 8 times since EGP began. We have never before kept up with the market after a 3% or greater rise.

Feather duster one day, rooster the next?