I am a fairly recent adopter of social networking. There are a number of reasons for that. On a personal level, I am a fairly self-sufficient individual. I love having my family around me and I generally enjoy the company of only a select few friends at rare social events. A wide social circle was never a priority; I preferred a small but highly valued social-network.

On a professional level, my primary income source is now investment income, so I don’t really need a wide ‘network’ to maintain that in the way someone who is primarily a ‘wage-earner’ does, I have a very small handful of similarly independent thinkers/investors I (very infrequently) communicate with. In fact, I would go so far as to say that having a very strong exposure to a network of like-minded individuals, along with exposure to business news and a general immersion in the daily movements of prices and other information of the like is could be dangerous for a person deriving their income from markets, potentially allowing group-influenced biases to creep in. One of the most important (in respect of its correlation with success in the investment industry) traits, in my view, is the ability to think completely independently. Even before I became a social networking consumer, I read widely and so was aware of trends, but a tool like a Twitter feed has an interesting effect on how hard a current trend gets hammered into your psyche.

I was persuaded by a friend recently that there would be some value in using Twitter as a newsfeed, improving my ability to access relevant information of interest to me, so I could spend less time searching & more time consuming information, as well as growing that avenue as a connection with my current investors (though the uptake here has been very slow – hint, hint) and potential future investors.

Before I used Twitter (I am @EGPtony if anyone cares to follow me – though I am primarily a consumer rather than a contributor), all my reading was sourced independently via my own meanderings around the web.

Now I have a powerful stream of links and comments pushed at me on my Twitter feed. I would hazard the top 5 stories on my feed this week were:

- Boston Bombing. When you follow (on social media) markets and people interested in the markets, I guess you need to prepare yourself for that moment when something tragic happens & instead of dealing with the ‘human’ element of it, you get the ‘market-reaction’. This was only a fleeting reaction & the majority of the coverage I encountered was properly sympathetic news coverage. The ‘market-reaction’ elements were a little distasteful, however, I am prone to occasionally finding myself using daily events in my life to look for ways to make money (it is my job!). I observe the types of appliances and goods in houses I enter, I’m prone to discussing peoples purchasing habits etc. (I try to be) like Peter Lynch – always attuned to economic behaviour of actors around me. However, when confronted with a true human tragedy, I’m pretty sure ‘profit’ would not enter my consciousness. Boston is one of my favourite cities, I wish its people well.

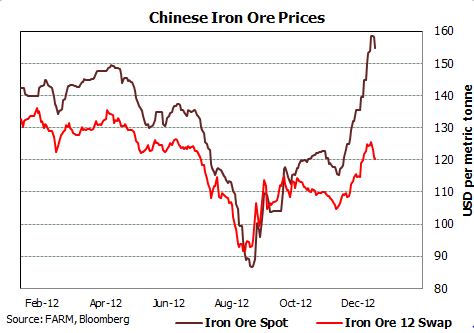

- Collapse of Gold Price. I have no interest in gold (even for jewellery I think Silver is nicer). However, it is an asset class that anyone following investment markets will inevitably encounter. The last couple of weeks have been ‘gold overload’ as the bottom has continued to fall out of the gold market. Now despite viewing gold as a useless asset, a funny thing starts to happen when you are constantly bombarded with news and opinions about the price. You find yourself wondering ‘what is it actually worth?’ Now gold has virtually no ‘intrinsic value’, very few industrial uses etc., but like all commodities; there is a price at which it is ‘uneconomic’ to produce. A price at which (eventually) supply will fall out of the market due to making a loss mining at below cost. We observed this with iron ore prices last year – the consensus was that insufficient ‘economic’ supply existed for the price of iron ore to trade below about US$100 per tonne. Yet for about 2 or 3 months – See below graph:

– last year it traded below this point, in fact it got down well below US$90 for a short time. So bombarded with enough ‘price’ information, you start (at least I do) to create models in your head to try and figure a valuation. When one finds oneself having these thoughts, one needs to slap oneself – HARD! You are speculating! Gold has no earning stream by which any sensible calculation of value can be made. I satisfy myself watching people’s reactions; apparently John Paulson’s funds have lost about $1.5B ‘investing’ in gold. I figure he’s probably smarter than I am, so if he can’t make money out of it, I’m probably sensible steering clear…

- Growth slowdown in China. This is something very important to Australian markets. Any major change in the economic condition of our largest trading partner could have major effects. To quote Barack Obama ‘Make No Mistake’ (I don’t think I’ve ever heard him give a speech without saying this) – if China stumbles any more than a little, it will hurt Australia. Despite this, I do think that we take a little too seriously minor variations in data. If China really is growing at 7.7%, even if it gradually slows to 5 or 6%, we (Australia) will do very well out of it. Japan was basically stagnant for 20 years and we still did very well exporting to them.

A bigger worry with China is ‘Can You Trust China’s Economic Data?’ We all thought Russia was a global power for a long time. It was a giant shell-game. I think China’s data is more reliable than that, but only because in the information age, twisting things too far will see you caught out pretty quickly.

- Carbon Tax/European Carbon Market. The European price traded down around €3 each. This is something like 1/6th of the price Australia has ‘self-imposed’ through the carbon tax. I won’t say too much here, I try to leave politics out of the blog as much as possible. However, despite many other economic issues in the Eurozone, if you don’t think Europe’s ‘leadership’ on carbon emissions has been a big contributor to its current economic malaise, I think you’re only deluding yourself. Big portions of some of those excessive debt/GDP ratios were built up subsidising uneconomic energy grids.

Likewise, if you don’t think the speed with which Australia has come back to the OECD pack in the last 12 months has been exacerbated by an environmental action 6x greater than the rest of the world, you are probably also misguided ‘Softly, Softly Catchee Monkey!’ would have been more sensible. When the facts change, we must change our mind. Whenever I think about our position on climate change I’m reminded of my eldest child’s first day at kindergarten, when he yelled at his new group of friends ‘everybody follow me!’ and ran off. When he got where he was ‘leading’ the group, he turned around and no-one had followed.

- Carryover from last week’s bitcoin price collapse. I have about the same level of interest in bitcoin as I do in gold (like watching someone fight a bear, I’m interested to watch, but don’t really want to get involved). In the last month, bitcoin prices have gone from about US$50 up to US$266 and most of the way back again. I remember thinking on the way up, perhaps in the mid to late-100’s, ‘this feels like a bubble to me’. Unlike gold, there is no real ‘floor-price’ apart from the limited circulation of bitcoins; bitcoin could go to zero, where gold cannot. If bitcoin is to be considered a legitimate alternative ‘currency’, it will have to solve the volatility issue. Even if Greece or Cypress should leave the Euro, I don’t expect they’d be anywhere near that volatile (after an initial ‘revaluation’ fall) and they’d be two of the least legitimate fiat currencies around.

The above issues are obviously shaped by the people I choose to follow. For example the fact that Justin Bieber wrote in the visitor book at Anne Franks’ house ‘I hope she’d be a belieber’ did come up on my feed, but only in a skirting way – thankfully, the less I know about that twat the better – But I’m sure it was bigger than most of the above stories for many Twitter users.

Of the above, the two stories that were most potentially dangerous to investors were obviously gold & bitcoin. The user needs to have the power to self-filter if they are to benefit from such media. It doesn’t take too much discipline to remember such matters are an interesting aside and not serious investment material – Tony Hansen 19/04/13

|

|

Apr 1st 2011 |

Jan 1st 2013 |

Current Price |

Current Period |

Since Inception |

|

EGP Fund No. 1 |

1.00000 |

1.21730 |

1.38818 |

14.04% |

38.82% |

|

35632.05 |

37134.53 |

39886.66 |

7.41% |

11.94% |

EGP Fund No. 1 Pty Ltd. Up by 14.04%, leading the benchmark by 6.63% since January 1st. Since inception, EGP Fund No. 1 Pty Ltd is Up by 38.82%, leading the benchmark by 26.88% all-time (April 1st 2011).