EGP hit a new all-time high this week (adjusted for the payment of dividends), surpassing the last peak set on 12 May 2013. The ASX200TR (our benchmark) is only about 1% off its all-time high (since the inception of EGP) attained on the same day. The first 5 weeks of FY2014 have gotten off to a blinding start; it will be interesting to see through August (reporting season) whether the optimism was justified.

I believe in Anthropogenic Global Warming (AGW). I read widely on any topic that is (or even perhaps could be) important to my investment decisions over the longer term.

In much the same way it should have been self-evident that smoking was harmful to a smoker’s health, I don’t see how anyone who has travelled the world and seen the extent of human industry could come to any other conclusion than that we must have an effect on nature and that effect is unlikely to be a positive.

Depending on where you source your research from, most studies indicate humans contribute between 3 and 5% of annual global Carbon Dioxide output (of around 800 gigatonnes annually – again depending on where you source information).

Naturally, what looks like a relatively minor contribution is derided by sceptics (along with the fact that we are also in the Earth’s natural ‘warming’ phase, making it very hard to distinguish AGW from the natural change), but nature tends to be finely tuned and an extra 4% annually is not as small an amount as it sounds. There is some evidence that nature is stepping up to the plate, almost half of this extra CO2 is being absorbed by the ocean. Half, but not all. And it must eventually have an effect, if our habits don’t change.

I am, however, not nearly as nervous about the consequences of AGW as most climate advocates seem to be. There is one extraordinary factor I think that is constantly misunderestimated (Thanks to G W Bush). Human ingenuity is almost boundless.

I have linked before to news stories of vertical farms, time and again we seem to avoid a Malthusian catastrophe, and adapt to new conditions as the needs arise. For nearly 200 years, the total number of people living in abject poverty has remained static or declined, despite around 6 billion new living earthly inhabitants.

When it comes to CO2 emissions, there will also be a confluence of factors that ensure alternative and zero emission energy sources rapidly become more attractive.

First is the finite nature of fossil fuels, I know people have called ‘peak-oil’ for 50 years – the very same ingenuity I’ve mentioned above keeps unearthing new fossil fuels. But oil is about $100 per barrel, around 10 times its price of 15 or 20 years ago, eventually; alternatives fuel sources will become cost competitive.

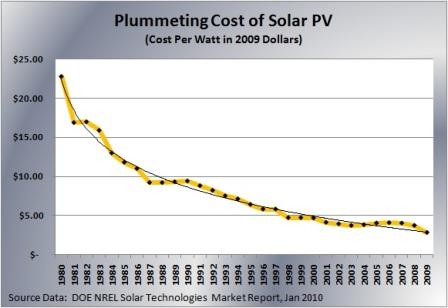

Secondly and accelerating the cost-competitiveness of other fuels, I read an article a couple of year back which posed the question “Does Moore’s law apply to solar cells?”. The answer a little more than 2 years hence would seem to be yes. I would love to see the chart below updated, but having observed the continued decline in solar prices over the last couple of years, I would hazard the trend line would hold:

The ‘missing link’ in renewable energy is storage; I would be surprised if some enterprising human doesn’t create an elegant (and marketable) solution to that problem within the next 15 or 20 years. Just look at how electric vehicles have improved over the last 15 years to see how rapidly change can come.

Couple the trends above with a burgeoning social interest in environmentalism, which will only grow further with every additional scrap of evidence that AGW is changing our world and all the factors are in place for a major change in human energy creation and consumption.

I know most everyone likes the government to ‘act’ on issues, but (and maybe I have too much faith in the markets) I truly believe AGW is one area where the worlds governments can step back and watch the market correct itself – Tony Hansen 04/08/13

|

|

Apr 1st 2011 |

Jul 1st 2013 |

Current Price |

Current Period |

Since Inception |

|

EGP Fund No. 1 |

1.00000 |

1.33220 |

1.42077*1 |

6.65% |

45.63%*2 |

|

35632.05 |

39163.27 |

41727.98 |

6.55% |

17.11% |

EGP Fund No. 1 Pty Ltd. Up by 6.65%, leading the benchmark by 0.10% since July 1st. Since inception, EGP Fund No. 1 Pty Ltd is Up by 45.63%, leading the benchmark by 28.52% all-time (April 1st 2011).

*1 after 31May 2013 dividend of 2.333 cents per share plus 1 cent per share Franking Credit

*2 calculated based on dividends reinvested