Update No. 46 – 10/02/12

First off this week, a Warren Buffett link which outlines a cogent argument, the basis of which he’s made many times before about why stock investments are not only brighter prospects, but also safer than alternatives such as gold and bonds when a long term view is taken. The simplicity of this analysis, which is apparently an extract from his upcoming 2011 shareholder letter, is poetic (to me at least), but the argument is absolutely valid.

My little addition to Buffett’s preference for stocks over alternative investments is that at least you can’t put your elbow through a stock… What should have been a handsome 13.7% per annum annualised gain on an art ‘investment’, devastated by a mishap.

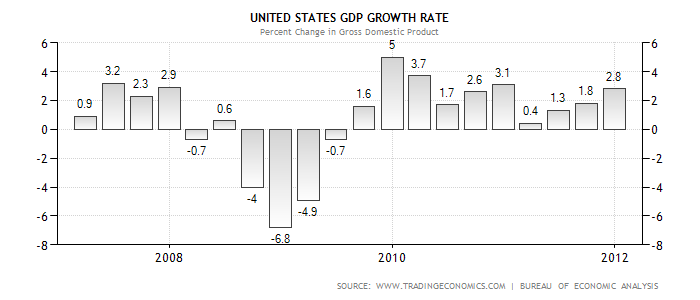

There is much belief (particularly from Keynesians) that the US economy is not coming out of ‘the great recession’ rapidly enough. The graph below displays US GDP over the last 4 or 5 years.

Looking at the graphical image above, you can see an average annualised GDP growth rate over the last 10 quarters of about 2.5% per annum. You can also see the rate of growth slid right back about a year ago, as nervousness about the impending end of QE2 brought about increased cautiousness. From that point, it is pretty hard to argue that given the reducing stimulus, ‘natural’ growth factors started to take up the slack. The inflation rate in December was 2.9%, which mirrors the NGDP, meaning there was very little growth in real US wealth (though I’m sure the 1% are still getting richer – at least in the eyes of the 99%). We need to be mindful of the fact that a nice long, slow recovery, accompanied by steady de-leveraging will be the most beneficial possible outcome for long-term global prosperity. Austrian and Keynesian economists alike will hate this middle ground, but I think it’s the most prudent course. In truth, in an advanced economy like the US, any prolonged spike above about 5% will lead to trouble, in my view, if the graph above can nestle into a ‘sweet-spot’ between 3 & 4% over the bulk of the next 10 or 12 quarters, while keeping inflation in check – we will all have much to be thankful for.

By way of comparison, Australian GDP is currently growing in that sweet-spot mentioned above between 3 & 4%, our inflation is about the same as the US rate too, meaning our economy is healthier, which I think most people recognise. In China, inflation over the last few months has declined steadily from about 6.5% to 4.5%, with NGDP declining to about 8% annualised. This leaves real GDP growth of nearly 4%, which is still very strong. In Europe of course, there are some different stories, Greek inflation runs at over 2% and the Greek GDP contracted by about 5.7% in the last 12 months (though it was positive in the most recent quarter). This means Greek RGDP declined by over 7.5% in the last 12 months, just serves to remind us Aussies we live in the lucky country – Tony Hansen 10/02/12.

|

|

April 1st 2011 |

Jan 1st 2012 |

Current Price |

Current Period |

Since Inception |

|

EGP Fund No. 1 |

1.00000 |

0.96254 |

1.00654 |

4.57% |

0.65% |

|

35632.05 |

30879.12 |

32341.05 |

4.73% |

(9.24%) |

EGP Fund No. 1 Pty Ltd. Up by 4.57%, lagging the benchmark by 0.16% since January 1st. Since inception, EGP Fund No. 1 Pty Ltd is Up by 0.65%, leading the benchmark by 9.89% all-time (April 1st 2011).