I spend, as I expect most investment professionals do, a lot of time reading and thinking about International Economic policy and its likely consequences. Coming as I do from Australia, a country that has been 21 years without a year of negative growth, it would be easy for participants from our country to be lulled into the sense that it will be ever so. I can assure you there will come a technical recession at some point in Australia’s future, although our Reserve Bank has done a much better job than virtually all others in advanced economies, in my view by following an NGDP path, rather than purely inflation targeting. Our highly traded (and fairly volatile) commodity currency also provides a substantial assistance to this process as I mentioned last week.

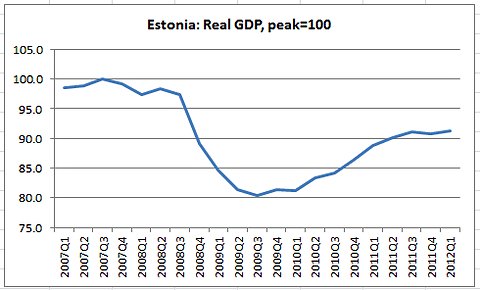

In any case, what I wanted to discuss this week was a little ‘feud’ that occurred a few weeks ago as a consequence of this blog post about Estonia by Paul Krugman. It was a short, relatively innocuous post, with ‘cherry picked’ dates that Krugman thought demonstrated what seems to be his opinion that any form of austerity, ever is always a bad thing… See graph:

The release of this was very rapidly followed by a Twitter tirade from none other than the Estonian President, Tom Ilves:

8:57 p.m. Let’s write about something we know nothing about & be smug, overbearing & patronizing: after all, they’re just wogs

9:06 p.m. Guess a Nobel in trade means you can pontificate on fiscal matters & declare my country a “wasteland.” Must be a Princeton vs Columbia thing

9:15 p.m. But yes, what do we know? We’re just dumb & silly East Europeans. Unenlightened. Someday we too will understand. Nostra culpa.

9:32 p.m. Let’s sh*t on East Europeans: their English is bad, won’t respond & actually do what they’ve agreed to & reelect govts that are responsible.

10:10 p.m. Chill. Just because my country’s policy runs against the Received Wisdom & I object doesn’t mean y’all gotta follow me.

My middle son is studying Economics at Sydney University; as such we often discuss various economic matters as they are areas of common interest. I pointed out the debate to him and in particular, we had a lot of fun with the 9:06pm tweet, where Ilves disparages Krugmans right to criticise Estonian fiscal policy because the Nobel Prize he won was ‘only’ for ‘trade’. Probably an in joke, but we found it quite hysterical; it is not the strongest basis for disparagement I’ve ever heard…

In any case, I stumbled across this Business Week article, which covered the feud and its fallout, with interviews from both Krugman and Ilves. I have to say, when I look at the graph of public debt here:

It is hard not to think that Estonia probably does make a pretty good ‘poster-child’ for austerity. It is particularly poignant when coupled with basically the same GDP information from Krugmans graph above, which pretty clearly demonstrates that the 2007 peak used by Krugman was a falsely inflated number:

Many commenters on the Business Week article describe Krugmans data-selection as ‘intellectually-dishonest’ and I think that would probably hold true, but I don’t know that Krugman would have made this mistake intentionally, we all have cognitive biases, a blog is a personal communication, generally with minimal review (certainly no-one reviews mine before I post) and is prone to fostering such bias. Just because you have a planet-sized brain like Krugman does not mean you have no cognitive bias.

That said, I would like to see for example Estonian GDP compared with some other countries over perhaps a 10 year period, despite the significant austerity used through the GFC, I would hazard there wouldn’t be too many countries with superior performance over such a timeframe. It certainly doesn’t disprove anything about austerity, Estonia seems to have averaged between 3 & 4% GDP growth through that time, despite the big plunge in 2009 – Tony Hansen 29/07/12.

|

|

April 1st 2011 |

Jul 1st 2012 |

Current Price |

Current Period |

Since Inception |

|

EGP Fund No. 1 |

1.00000 |

1.02993* |

1.07728 |

4.6% |

7.73% |

|

35632.05 |

31904.52 |

32807.59 |

2.83% |

(7.93%) |

*Unaudited figure to be confirmed externally

EGP Fund No. 1 Pty Ltd. Up by 4.6%, leading the benchmark by 1.77% since July 1st. Since inception, EGP Fund No. 1 Pty Ltd is Up by 7.73%, leading the benchmark by 15.66% all-time (April 1st 2011).