The Berkshire Hathaway AGM was held last weekend. I thought I’d discuss something from that in this mid-month update.

It has become something the ‘cool kids’ do, to disparage Warren Buffett. Shows they’re not just star-struck cheerleaders of the best investor in history…

I do not wish to do that, his investment writings are a big part of why I do what I do and why it invokes such passion in me. But I do want to touch on something he said at the AGM that was exceptionally disingenuous.

In response to a Carol Loomis question about the high cost of active management, Buffett stated in his whole lifetime, he’s only known a dozen people who could be relied upon to consistently deliver outperformance.

Now in his seminal piece ‘The Superinvestors of Graham-and-Doddsville’ (.PDF), Buffett describes 9 investors, whose cumulative record over the 138 years of investment examined looks as follows:

- Benchmark performance – 8.49%

- Superinvestor performance (pre-fees) – 23.14%

The best part about the ‘Superinvestors’ piece is that it wasn’t just a clever ‘Post Hoc’ selection. To the extent that continuing records are available for the 9 managers, it continued to support their ability to outperform, though by lower margins as the sums they managed increased and markets became more efficient.

Walter Schloss for example, continued to manage money for another 19 years after the ‘Superinvestors’ article. His advantage over the index declined a little, but in a market that averaged nearly 12.2% from 1983 until his retirement, Schloss still delivered about 20% before fees.

So in 1983, Buffett already knew 9 people who could be relied upon to invest money and best their benchmark. Given he’s now claiming he’s only known 12, it means he’s met only 3 more since.

We can also assume that since he’s employed Todd Combs and Ted Weschler to invest large chunks of Berkshire’s capital that he considers these fellows capable of consistently beating the benchmark.

This means, there is only one other person in his whole life that Buffet has met he considers able to deliver a consistently above market performance. Makes you wonder who it is doesn’t it…

Li Lu perhaps (interesting Li Lu interview here [.PDF]), who manages much of Charlie Munger’s non Berkshire wealth and has been suggested as a Buffett successor?

Perhaps Mohnish Pabrai?

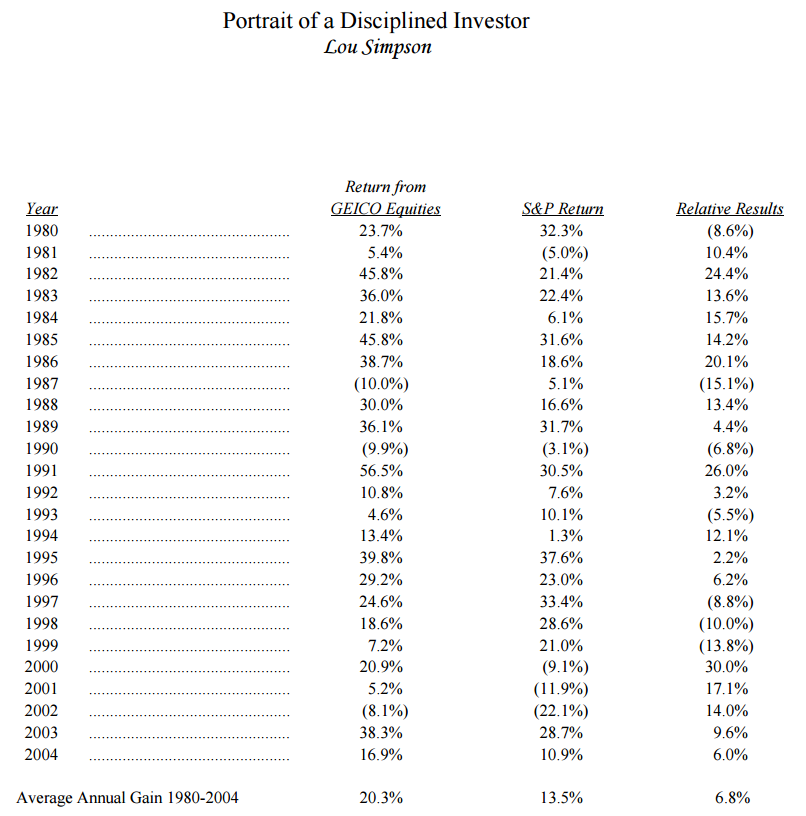

Perhaps it’s Lou Simpson, whose record Buffett himself called out in the 2004 Annual Letter (.PDF), which set out a 25 year long record of outperforming the benchmark by more than 50% (20.3% annually versus 13.5%), including besting the S&P return 18 out of 25 years (72% of the time).

My point is I’d say Buffett absolutely has known a good deal more than 12 people capable of outperforming the index consistently. And that it is intellectually dishonest of him to claim that he hasn’t.

I fully understand his desire to encourage the majority of people to use index funds. As a default option, it’s superior to the alternatives. But in the same way I think it’s foolish for anyone concerned about climate change to use every drought or cyclone as ‘evidence’, it is more important to consistently be honest about the facts.

As with climate change, I can likewise understand the sense of urgency indexing proponents feel. But just like we have always had extreme weather events, there have always been, ever since capital markets have existed, people who could consistently generate returns superior to the broader market.

In the climate change example, evangelists would be far better to simply and eloquently point out the positive risk/reward scenario for humanity moving as swiftly as possible toward a zero carbon economy, rather than exaggerate current events to create a sense of urgency.

For indexing evangelists, likewise hyperbole is not necessary. It is a simple truth that the majority will get a better outcome using a consistent savings plan and low-cost funds than high-fee active managers and some wrongheaded market timing. The fact there are a considerable number of people capable of outperforming the benchmark doesn’t diminish this important fact.

Buffett would be far better to consistently remind us that despite plenty of people being capable of outperforming the broader market, it is fee structures that ensure indexing is a superior alternative virtually all of the time.

To this end, it surprises me that (aside from his own partnership using a zero-fee structure) Buffett has not pointed out the simple solution for wannabe active managers to enable their industry to survive and thrive:

- Charge zero, or very near zero fees; and

- Earn a fee when you deliver performance above a predetermined level.

Interestingly, when mentioning other investors who might make the list of Buffett’s dozen outperformers, aficionados will notice that both Li Lu and Mohnish Pabrai both mimic the 0% fee, 6% hurdle & 25% outperformance structure the Buffett partnership operated. My friend Peter Phan at Castlereagh Equity also uses this model. In fact, I have not yet come across someone who mimicked the Buffett Partnership fee structure and wasn’t quite a gifted investor.

“Whose bread I eat, his song I sing” they say.

Well it seems when there’s no free bread (management fees) then I’d best write my own damned songs (deliver outperformance) to earn some bread, or I’m going to be very hungry… – Tony Hansen 15/05/2017

P.S. We visited Kangaroo Island last week. I have nothing further to add at this stage as we have considerable inflows due in the coming months and it is possible, even likely that we will try to grow our position should the price remain near the capital raising price. So I shan’t comment further. For now…

| Apr 1st2011 | Jun 30th2016 | Current Price | Since July 1st 2016 | Since Inception | Annualised | |

| EGP Fund No. 1 | 1.00000 | 1.70130 | 2.0720*1 | 21.79%*1 | 155.98%*2 | 16.59%*2 |

| Benchmark | 37333.23 | 52006.69 | 61075.54 | 17.44% | 63.60% | 8.37% |

*1 after a 31 May 2013 dividend of 2.333 cents per share (cps) plus 1.000 cps Franking Credit, a 31 May 2014 Dividend of 7.000 cps plus 3.000 cps Franking Credit and a 31 May 2015 Dividend of 8.6667 cps plus 3.7143 cps Franking Credit and a 31 May 2016 Dividend of 6.0000 cps plus a 2.5714 cps Franking Credit

*2 calculated based on dividends reinvested

Thanks for the update.

I am curious about your visit but happy to wait until you are ready to share.

What is the attitude of the locals with respect to the proposed pier?

From what I have read, a ‘tails’ outcome still yields a good result, whereas ‘heads’ would be outstanding.

Christian, we’re definitely of the view that it’s a ‘heads we win, tails we’re unlikely to do poorly’ situation. Given we spend so much time thinking about downside, such situations are very attractive – Tony

“Buffett would be far better to consistently remind us that despite plenty of people being capable of outperforming the broader market, it is fee structures that ensure indexing is a superior alternative virtually all of the time.”

Succint and to the point.

Thank you.