We have committed to revealing our positions as they are finalised. The investment we will discuss this month is Global Construction Services (GCS). GCS is a fairly small business in the engineering and construction sector.

It was the first new business we bought with conviction after the new EGPCVF trust was created on August 15th. As is the case with many of our ideas, this one was brought to us by our extended network. The idea came to us from Peter Phan, who runs a little investment company (Castlereagh Equity) in very much the same manner as our original fund (EGP Fund No. 1 Pty Ltd). Before you flood Peter with cash, his fund operates with similar restrictions to what ours used to, and he only takes new investors in February and in limited numbers.

Nevertheless, Peter is worth keeping on your radar because as with any talented money-manager who runs money on a fee-free basis, eventually the market will demand he operate a larger vehicle open to all-comers.

Peter has been asking for my view on GCS, what he was missing (like all good investors, he is obsessed with where he could be wrong) with this stock as the valuation multiples appeared extraordinarily compelling in a market where obvious value is not easy to find.

After months of trying to see chinks in the armour, I did what I often seem to do with good ideas from Peter and we joined him. Our GCS investment speaks for 7.1% of our portfolio at the end of October (Castlereagh delivered a 6.8% performance this month, so Peter must have kept some more tricks up his sleeve he didn’t tell me about…).

Our all-in (i.e. including brokerage) cost-base for our stake in GCS is 54.85 cents per share. At that price, the business had a market capitalisation of $115.75m.

At the most recent report date (30 June), the business was net-cash to the tune of around $3.75m, so the enterprise value was about $112m.

The trailing twelve month (TTM) valuations were:

EV/E = 10.3x (7.9x on an ‘underlying basis’)

EV/EBITDA = 3.85x

EV/EBIT = 4.75x

FCF (operating cashflow less net PPE investment) yield on EV = 14.1%

Written down net tangible assets exceeded enterprise valuation.

The valuation was undemanding to say the least on a trailing basis.

To be fair, the company had made some dreadful capital allocation mistakes in the preceding few years, as could be evidenced by the $106m impairment brought to account in the FY2016 annual report. The primary operating business was focussed on Western Australia and mistimed asset purchases at the top of the last mining cycle.

Markets though are usually forward looking (eventually) and based on the company guidance of at least ‘double digit’ earnings growth, I had them for FY18 earnings on these forward multiples (from the $112m EV purchase price, which assuming free cashflow after an estimated 3cps of FY18 dividends would reduce to around $100m):

EV/E = 6.4x

EV/EBITDA = 3.08x

EV/EBIT = 3.77x

FCF (operating cashflow less net PPE investment) yield on EV = over 17%

It is hard to find businesses with apparently bright futures trading on less than 7x earnings and around 3x EV/EBITDA. As with a number of recent positions in the portfolio, GCS is well positioned to take advantage the nascent construction and infrastructure boom.

GCS is an enormously cash generative business and despite poor investment decisions such as described above at the top of the last WA cycle, the debt taken on to execute those poor decisions has now all been extinguished.

The last two purchases the company made have shown signs of being outstanding acquisitions and seem to demonstrate management has learned important lessons about capital allocation.

One of those businesses is that Gallery Facades business, which we figured at time of purchase potentially justified the entire EV of the company if the industry plays out over the next few years as we anticipate.

The tragedy of the London’s Grenfell Tower in June of this year exposed a horrific oversight globally in the building and construction industry. The highly flammable cladding used on the building brought to light the many thousands of buildings Australia-wide covered in similarly dangerous products.

The Gallery Facades business already has hundreds of millions of dollars in active tenders to clad the new buildings under construction as the apartment boom underway in Australia’s capital cities continues. Inevitably this boom too will pass, but the remedial work will in all likelihood tide Gallery Facades over until the next apartment building boom begins.

Our view of the way this likely plays out is that in the first instance, insurers will likely make fire risk assessments of buildings in light of the Grenfell tragedy and more properly assess the risk they are taking on. This will lead to a substantial rise in premiums.

The likely first outworking of this change will be that buildings with single owners such as large corporations and Government agencies will immediately seek to remedy the issue, rather than accept the annuity expense of higher insurance premiums (and the likely consequent fall in the underlying asset value). This we expect will take a few years.

The second wave of this remediation will likely involve strata bodies that will take many years to build their ‘sinking funds’ to a sufficient level that they will able to afford the required remedial work.

The Gallery Facades business is facing a very rich opportunity set which, if properly executed on should augur for a quite long and very bright period in that business.

The variety of other businesses GCS own and operate similarly face demand conditions not seen for many a long year. The east coast infrastructure boom is expected to more than double average infrastructure spending levels over the preceding ten years in the decade ahead. Players even operating on the fringes of these markets should see improved margins as supply is soaked up.

We have had a number of meetings with Enzo Gullotti, the CEO of GCS over the past couple of months have also given the impression that their foundation market in Western Australia is offering an opportunity set also not seen for ages. Hotel and shopping centre expansion that had been on hold as the mining boom drove construction costs in WA to uneconomic levels for such activities are now being activated.

Finally, GCS announced on 27/28 September that they are selling their equipment hire division for above the $23m carrying value (an announcement on the last day of October confirmed the price would be $29m). This will add substantially to the already strong balance sheet, remove a $10m per annum cash drain in servicing the hire-purchase facilities and eliminate a business that had been earning next to nothing, potentially allowing the capital to be redeployed in better earning opportunities (or returned to shareholders somehow).

This will leave GCS with a suite of fairly capital light businesses that should be even more cash generative than the business already was. Even though the shares are more than 50% higher than our purchase price in less than 2 months, we still think there is plenty of room for the valuation to grow further in coming months and years if execution is good.

In other news, we did a little selling this month as we slowly exit positions that are small or that have traded up to a point that the expected return is below what we consider acceptable.

The two holding we have completed disposal of this month are SRY.AX (Story-I Limited) this was our smallest position and an ill-advised foray where we lost money. Fortunately, it was so small that when I checked the damage done, we had to go down to the 4th digit of the unit price and even then, the movement was small.

The second business we exited our holding of was PNC.AX (Pioneer Credit). This was a good result for the fund (this holding went across both funds) as we realised an IRR of 130.24% (excluding franking credits received) from this fairly short-term investment. We acquired our initial stake by sub-underwriting a capital raising done in April this year. Unfortunately the raising was very well supported & our sub underwriting left us with a fairly modest holding (even in terms of the old fund which was less than a third the size of our present operation). We nibbled away at a little more stock when the price retreated below $2.40 in early September, but the price has run aggressively since then and we exited at an average price of just over $2.88 toward the end of the month, having failed to build a proper position. The operation at PNC is an impressive one and it’s not out of the question I regret selling this business as I do liquidating a holding in their peer CCP.AX (Credit Corp) in March 2011 at $5.50 to generate cash for the launch of the original EGP Fund (CCP now trade at over $20 per share, having paid more than $2.50 in dividends since that sale…). The market has certainly disagreed short-term as PNC has risen steadily since our sale.

I will now try something I have never done before and telegraph one more share sale we are likely to make in coming weeks and months. Despite the very large disclaimer appended to the bottom of everything I write, I will preface the following four paragraphs with “this is not financial advice!!!”

We have a very small holding in RFP.NSX (Rural Farms Poultry – an NSX listed chicken farming business). We are looking to sell this holding in part because it has had a substantial appreciation in valuation since we acquired and in part because it is now too small a position for the fund.

I wrote a blog on RFP a couple of years back, which should give a decent grounding in what the business does. It remains a business with the market cap substantially backed by its cash hoard. I write about this pending sale as there are likely readers of this blog for whom the quarterly 2.5125c fully franked dividend would be a nice little regular income stream. Unfortunately it speaks for only about ¼% of the portfolio and as a ‘concentrated investor’, we are better to focus on a position we are able to grow to a more meaningful size.

I aim to get a price of $1.30 per share for our holding (we have 115,205 shares remaining, which you can see on the offer at the NSX website), which is a few cents above the current trading price. With that said, at that price, the buyer would be purchasing a grossed up yield exceeding 11%, which I think is leaving enough on the table to make the buying attractive (we generally sell when our expected IRR dips below 10%, with an 11% yield & still some potential for capital growth, we are being unusually generous… Don’t get used to it!).

Let me be clear to existing EGP investors, I believe the fund, measured over a reasonable term will perform better than RFP. Given the choice between the two alternatives, I would add to my EGPCVF holding (again, not financial advice…). But with that said, to someone for whom a regular income stream is important, this could be worth investigating. Feel free to contact me if this has piqued your interest – Tony Hansen (05/11/2017)

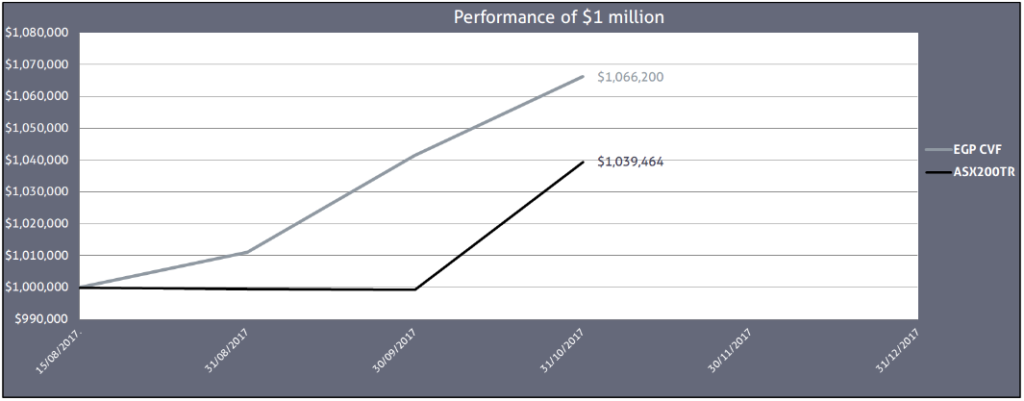

| August 15th 2017 | Current Price | FYTD | Annualised | |

| ..EGP CVF | 1.0000 | 1.0662 | 6.62% | 36.0% |

| Benchmark .. | 56174.93 | 58391.81 | 4.01% | 20.8% |

DISCLAIMER:

EGP Capital Pty Ltd (ABN 32 145 120 681) (EGP Capital) is the holder of AFSL #499193. None of the information provided is, or should be considered to be, general or personal financial advice. The information provided is factual information only and is not intended to imply any recommendation or opinion about a financial product. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should consider seeking your own independent financial advice before making any financial or investment decisions. The information provided in this presentation is believed to be accurate at the time of writing. None of EGP Capital, Fundhost or their related entities nor their respective officers and agents accepts responsibility for any inaccuracy in, or any actions taken in reliance upon, that information. The EGP Concentrated Value Fund (ARSN 619879631) (Fund) discussed in this report is offered via a Product Disclosure Statement (PDS) which contains all the details of the offer. The Fund PDS is issued by Fundhost Limited (AFSL 233045) as responsible entity for the Fund. Before making any decision to make or hold any investment in a Fund you should consider the PDS in full. The PDS will be made available by contacting EGP Capital (info@egpcapital.com.au). Investment returns are not guaranteed. Past performance is not an indicator of future performance.

Thanks for the blog Tony – love reading about your thinking behind stock valuations and selections. One question for you – when you do sell a holding do you do any analysis months or years down the track as to whether that was the right decision (from an intrinsic valuation perspective)? CCP being case in point. If you do this type of analysis what sorts of themes, if any, do you uncover where stock selection can be improved?

I think about it a lot. We have a much better record buying than selling.

With that said, historically, we have (on average) done a better job in applying the funds received from selling to new investments than if we had not sold.

There are notable exception such as FLT, SSM & CCP. But we have occasionally done a quite good job in timing sales too.

Problem is our minds are inevitably drawn to the errors as they cause much pain – Tony

Yes, good point on the opportunity cost (I didn’t think of that).

The opportunity cost calculation is a tricky one as one must figure for tax. On average, based on my efforts we’ve mostly done the right thing selling – Tony